Over the weekend, silver topped $80 in U.S. markets, and hit over $90 in China.

It has since dipped 10% or more on news that a major bank hit a margin call and had to liquidate silver positions.

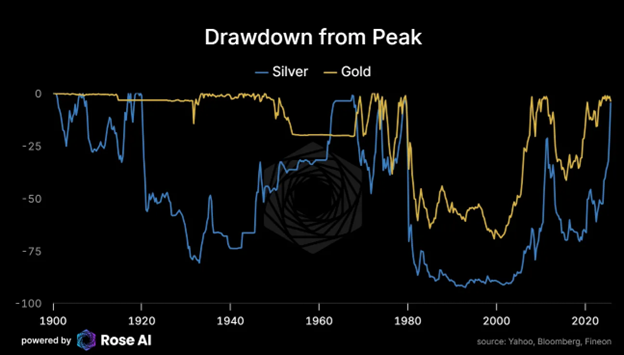

Maybe this “margin call” story is the catalyst, but it’s also the case that silver is one of the most volatile commodities and it was due for a 10% correction (at least) after rising 25% in just 10 days – and more than 150% before this latest correction.

I obviously could not have known that silver would hit $80 an ounce before falling 10% – but I still advised all of my paid readers on Friday to trim their holdings across the board by 20%.

I wrote:

“I’m sure you’ve heard of the expression ‘When pigs fly’ expressing an extremely low probability event. Well, pigs are literally flying in the Gold & Silver markets. GP sees a marked increase in speculative activity which means that metal prices are likely due for a temporary correction to cool off before rising higher once again.

If you have been with GP for a while, we recommend you sell 20% of your positions. If you are new here, use 50% of your capital to establish your positions then wait for better lower prices. As sure as day follows night, a market correction follows a strong runup. We will reinvest the raised cash when the market inevitably cools off. Or, if the market continues higher, and shares become more expensive, GP will raise more cash.”

If you feel like you’ve missed out on silver’s massive move, I have good news:

Silver is going to give you at least one but probably several more bites at the apple. We’re going to see a substantial correction – and it could already be underway.

Even in the middle of the bull run in the 1970s, silver corrected more than 30% on multiple occasions. If you want to participate in the rodeo that is the silver market, you have to be very cautious about when you put money in and when you take money out.

That’s why I urged my readers to trim 20% on Friday. Bull markets are completely pointless and wasted if you don’t take money off the table! In precious metals stocks especially (except for royalty companies), you’re not earning dividends. To profit, you need to sell at some point.

But the main thesis for higher gold and silver prices is still intact. Gold is for the first time in a century being recentered monetarily in the global financial system.

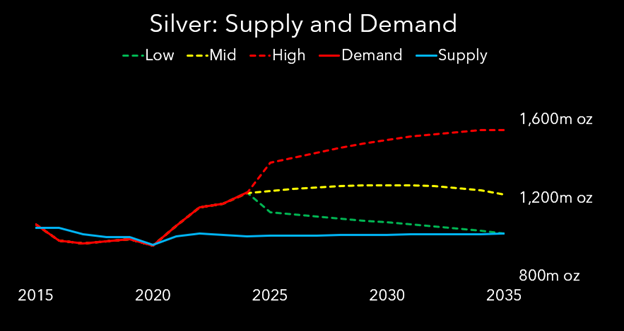

Silver supplies are extremely constrained, while China is about to cease exports on January 1st, and solar panel construction is slated to grow for years while existing supply is well under current demand.

There’s only one cure for supply constraints like this – and it’s much higher prices.

But the takeaway for investors in this kind of bull market is that you have to take advantage of opportunities – on the upside and the downside.

Take profits when you can, especially when the market is screaming higher – and redeploy capital later when prices come back to earth.

Be ready. I will be sending you my best opportunities as they come.

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio